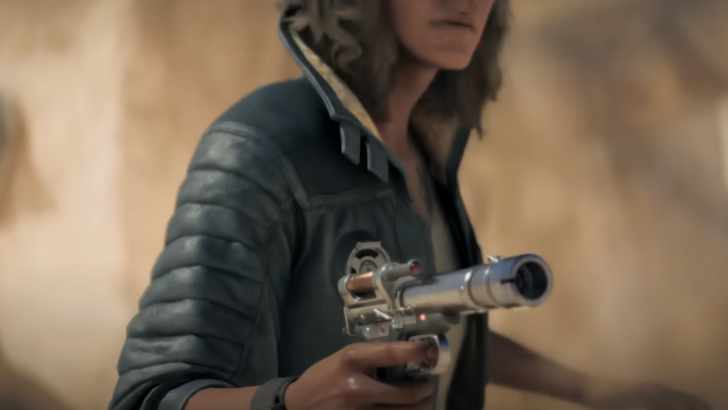

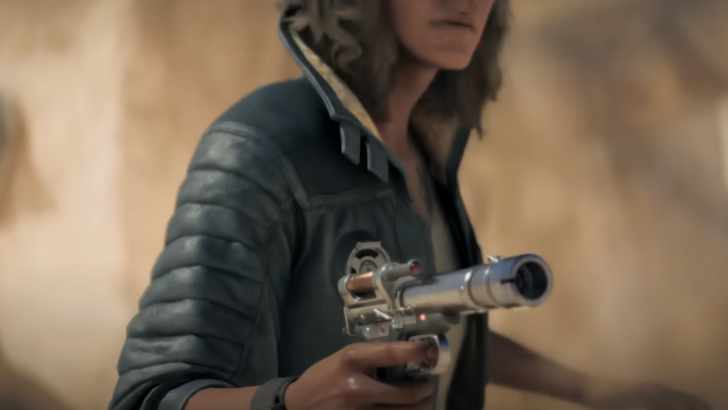

Ubisoft's Star Wars Outlaws, initially anticipated as a major financial boost, has reportedly underperformed in sales, impacting the company's share price. Last week saw a significant dip, raising concerns about the game's market reception.

Ubisoft's Star Wars Outlaws, initially anticipated as a major financial boost, has reportedly underperformed in sales, impacting the company's share price. Last week saw a significant dip, raising concerns about the game's market reception.

Ubisoft's Hopes Rest on Star Wars Outlaws and Assassin's Creed Shadows

Stock Price Plummets

Ubisoft positioned Star Wars Outlaws, alongside the upcoming Assassin's Creed Shadows (AC Shadows), as key drivers of future growth. Their Q1 2024-25 sales report emphasized these titles' importance in revitalizing the company's financial performance. The report also highlighted a 15% increase in console and PC session days, largely due to Games-as-a-Service, with monthly active users (MAUs) reaching 38 million – a 7% year-on-year rise.

Ubisoft positioned Star Wars Outlaws, alongside the upcoming Assassin's Creed Shadows (AC Shadows), as key drivers of future growth. Their Q1 2024-25 sales report emphasized these titles' importance in revitalizing the company's financial performance. The report also highlighted a 15% increase in console and PC session days, largely due to Games-as-a-Service, with monthly active users (MAUs) reaching 38 million – a 7% year-on-year rise.

However, Star Wars Outlaws sales have been underwhelming, described as "sluggish" by Reuters. J.P. Morgan analyst Daniel Kerven lowered his sales projection from 7.5 million units to 5.5 million units by March 2025, citing the game's failure to meet expectations despite positive critical reviews.

The release of Star Wars Outlaws on August 30th triggered a two-day decline in Ubisoft's share price. The stock fell 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning, reaching its lowest point since 2015 and extending its year-to-date drop to over 30%.

The release of Star Wars Outlaws on August 30th triggered a two-day decline in Ubisoft's share price. The stock fell 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning, reaching its lowest point since 2015 and extending its year-to-date drop to over 30%.

While critics generally praised the game, player reception appears less enthusiastic, reflected in a 4.5/10 user score on Metacritic. Conversely, Game8 awarded Star Wars Outlaws a 90/100 rating, hailing it as an exceptional addition to the Star Wars universe. For a more detailed perspective, consult our full review (link below).

Ubisoft's Star Wars Outlaws, initially anticipated as a major financial boost, has reportedly underperformed in sales, impacting the company's share price. Last week saw a significant dip, raising concerns about the game's market reception.

Ubisoft's Star Wars Outlaws, initially anticipated as a major financial boost, has reportedly underperformed in sales, impacting the company's share price. Last week saw a significant dip, raising concerns about the game's market reception. Ubisoft positioned Star Wars Outlaws, alongside the upcoming Assassin's Creed Shadows (AC Shadows), as key drivers of future growth. Their Q1 2024-25 sales report emphasized these titles' importance in revitalizing the company's financial performance. The report also highlighted a 15% increase in console and PC session days, largely due to Games-as-a-Service, with monthly active users (MAUs) reaching 38 million – a 7% year-on-year rise.

Ubisoft positioned Star Wars Outlaws, alongside the upcoming Assassin's Creed Shadows (AC Shadows), as key drivers of future growth. Their Q1 2024-25 sales report emphasized these titles' importance in revitalizing the company's financial performance. The report also highlighted a 15% increase in console and PC session days, largely due to Games-as-a-Service, with monthly active users (MAUs) reaching 38 million – a 7% year-on-year rise. The release of Star Wars Outlaws on August 30th triggered a two-day decline in Ubisoft's share price. The stock fell 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning, reaching its lowest point since 2015 and extending its year-to-date drop to over 30%.

The release of Star Wars Outlaws on August 30th triggered a two-day decline in Ubisoft's share price. The stock fell 5.1% on Monday, September 3rd, and a further 2.4% by Tuesday morning, reaching its lowest point since 2015 and extending its year-to-date drop to over 30%. LATEST ARTICLES

LATEST ARTICLES